How to beat the recession blues

Planning your business through tough commercial times will be more of a necessity than ever, sales may be not as productive as before, cashflow may be tight. See my 6 point tips that will see you through. These methods work time and time again, so give them a try.

Look at your product or service

If sales are not converting as quickly as they were before look at what added value you can offer as part of that service to make it more appealing to your target market.

What is your Unique Selling Point?

What is your client retention? Its cheaper and easier to have a customer returning to you time after time, than them coming once, then never returning. This could be a project in itself.

First you need to know who are you are targeting.

Look at your demographics, ie

Selling direct to the general public

Age groups

Location is the product or service local or national, global

Gender

Business to business

Small businesses

Large business

Specific industry’s

The Competition

How is your product different, what are the added features

Separate yourself from everyone else

Are you cheaper

Are you local

Can you incorporate postage costs within your price

Take a look at the large corporations, they would have seen plenty of tough times, how do they get through the recession. Learn from the experts.

In times of recession price sensitivity and quality are always a priority for your customers.

Pricing Structure

How do you cost your product or service.

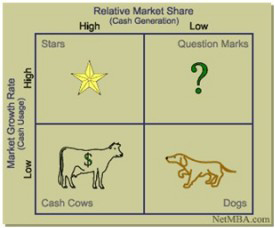

For example use the BCG Share Growth Model as below. This will help you assess which products are making you profit, which are not.

Split your costs and services into 4 categories, see the picture example.

Stars

Products that are high volume and high margin. These may be products that have always been good sellers, and a favourite with your customer.

Question Marks

Products that are low volume and high margin. These might be a niche market product that only appeals to a certain audience.

Cash Cows

High volume products, low margin. Low value products, but you sell a lot of them.

Dogs

Low volume and low margin. Products that don’t really have market, obsolete stock etc.

Costs

The cost of sale

Who do you buy your materials from

If you deal with a retailer, maybe its time to negotiate.

Look at your high volume products, can you buy direct from the wholesaler, you will save at least 30% doing just this. Look at your stock levels, even holding stock for three months. Look at the possibility of the savings versus cash outflow in holding stock. It might work out a better option.

Overheads

Assess every cost you have from the every overhead from rent, heating, electricity, the phone bill. Even the stationery bill. Get your negotiating skills at the ready. If your struggling, they may be too. They need your business.

Look at local businesses and see what they can offer, you’ll be helping your community and possibly reduce your logistics costs too.

The wages bill, it is a high cost for a business, make sure you get the maximum out of your investment. Don’t see your staff as just employees, they are an investment in your future. Look at training, how can they add value to your product or service.

Look at your car and fuel costs, don’t make unnecessary travelling journeys.

Don’t spend on unnecessary costs, keep the frills for the better times.

Cashflow

Look at all ways of protecting your cashflow. Plan ahead put together cashflow plans, even a simple one will show you ahead of time when you are going to need to fill the gap. Is your business seasonal. If you see a drop in cash, start saving for it now. Don’t leave it to the deadline date as you wont have given yourself enough time to build up your cash reserves.

Investment in capital expenditure, or taking on staff, assess a long term plan the viability of this, before you spend. Growth is lovely, but staying open is more important.

Look at ways to ease the cashflow burden. Look at your weekly, monthly overhead costs. Ie Ask yourself this question “What do I need to sell to cover my overheads.”

Gain credit from your suppliers.

Look at an overdraft facility with the bank, yes they charge, but you never know when you might need the cushion.

Look into leasing your fixed assets, this will also help with the cashflow.

Pay your VAT, PAYE monthly, at least it will reduce large amounts of cash going out of the bank at three monthly intervals. Ie spread the cost.

Look at your long term, possibly obsolete stock, sell to a scrap merchant, hold a sale. It costs money to sit in your warehouse.

Diversify

If you are not hitting the right note with your customer, maybe think about other sources of income. Look at the market place, what market isn’t saturated yet.

What services are connected with your products, its all about adding value to what you do already.

If your business is seasonal, what can you do with that time to keep the cash coming in. If its routine every year, make this year different.

This blog is intended for information purposes only and is only advice from past experience, you may have other suggestions of your own. It is not intended to be used to make all of your business decisions but as a guide only.